How it Works

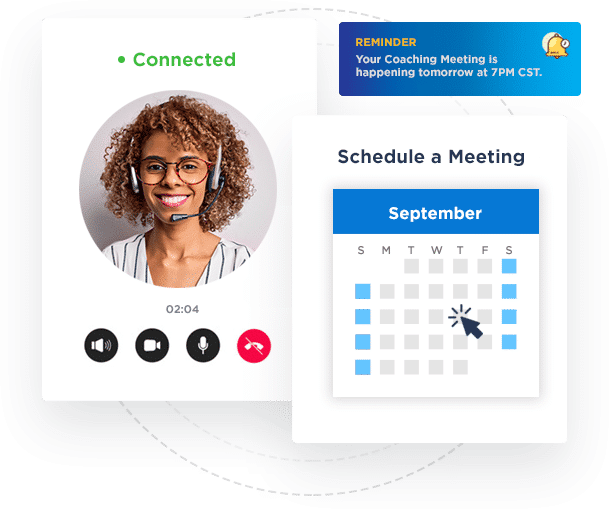

Unlimited 1:1 Coaching

FinPath University Courses

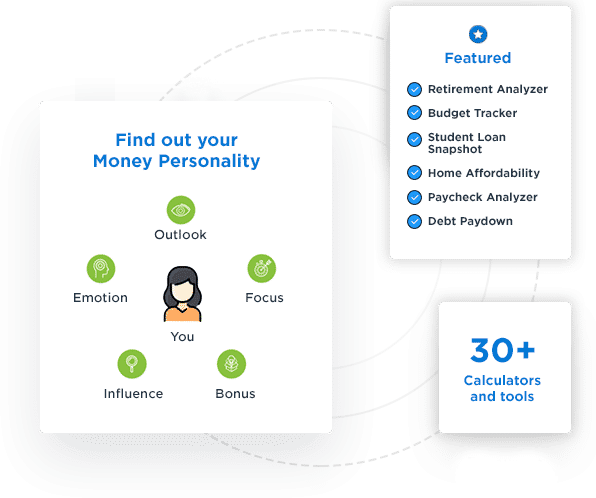

Financial Health Tools

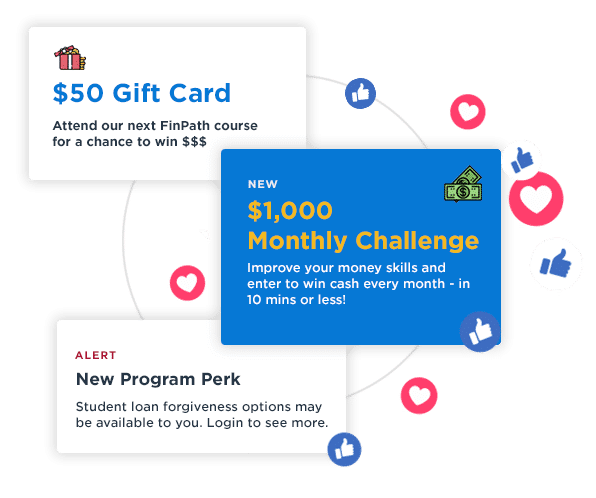

FinPath Program Perks

Coaching

Financial Coaching & Support Network

Truly setting FinPath apart from other programs is to a large network of Wellness Coaches ready to help users navigate their financial journey.

Wellness Coaches do not work on commission and are completely unbiased—they are simply there to help. Sometimes it’s more convenient to speak with a real person who can explain things in a way that a video or learning module can’t.

Anywhere, anytime

Times have changed and so have we. Meet with a coach via phonelive video chat, or in person.

Courses

Step up your money skills with FinPath University

Courses are for everyone, no matter what sort of prior finance knowledge you have. Start with beginner 101 courses and move your way up the ladder with more complex topics. We break down complex financial topics using everyday situations.

Popular courses this year:

- 5 Tips to Maximize Your Paycheck

- Credit is a Powerful Financial Tool – Use it to Your Advantage

- Manage Your Debt or Your Debt Will Manage You

- Student Loan Forgiveness

Financial Health Tools

Take action and track your progress with powerful financial wellness tools

With FinPath, you have a complete suite of online tools to help you take control of your finances. FinPath encourages you to perform a series of goals to improve your financial wellbeing—like establishing emergency savings funds, improving credit score, lowering their debt, and more

From retirement, to vacations, to buying a home, we can help you project how much you need to save to accomplish every goal.

Program Perks

Get rewarded for improving your financial wellbeing

FinPath partners with a list of preferred providers to bring you even more resources and rewards.

Current perks include:

- $1,000 monthly content

- Student loan forgiveness evaluations

- Identity protection and credit monitoring discounts

- Debt consolidation & emergency loans

- Nonprofit referral services

More coming soon!

Elya W.

“The one-on-one consultations helped me break down my spending and see where I could begin saving! I learned about different aspects of credit and retirement that I didn’t know and have been able to help friends and family better understand them.”

Marilyn M.

“I now feel more financially secure. I don’t feel stressed. I feel like I’m on the path to financial independence…I just checked my credit score [and] since I’ve been working with my coach, watching the seminars and using the financial health tools, my credit score went up 56 points.”

Pamela D.

“Aaron always immediately grasps the direction I am headed…our session are very dynamic and productive.”