Town Hall: Get to Know Foundation 99

Join us for 30 minutes to learn all about Foundation 99, a financial wellness program designed to help you build better money habits at no extra cost to you.

We’re giving out two $25 gift cards to attendees. RSVP below to enter!

Wednesday, September 20 @ 2 PM CST

Presented by Rebecca Lenard

Discover Foundation 99

Watch the video below to learn what Foundation 99 can do for you!

Coaching

Financial Coaching & Support Network

What sets Foundation 99 apart from other programs? A large network of Financial Coaches ready to help users navigate their financial journey.

Financial Coaches do not work on commission and are completely unbiased—they are simply there to help. Sometimes it’s more convenient to speak with a real person who can explain things in a way that a video or learning module can’t.

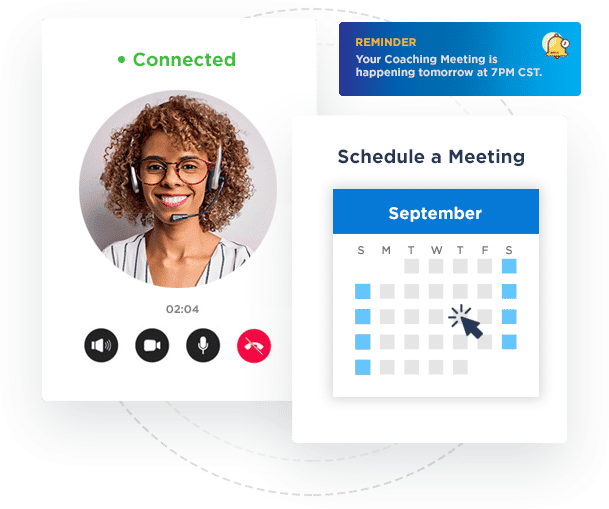

Anywhere, anytime

Times have changed and so have we. Meet with a coach via phone, live video chat, or in person.

Courses

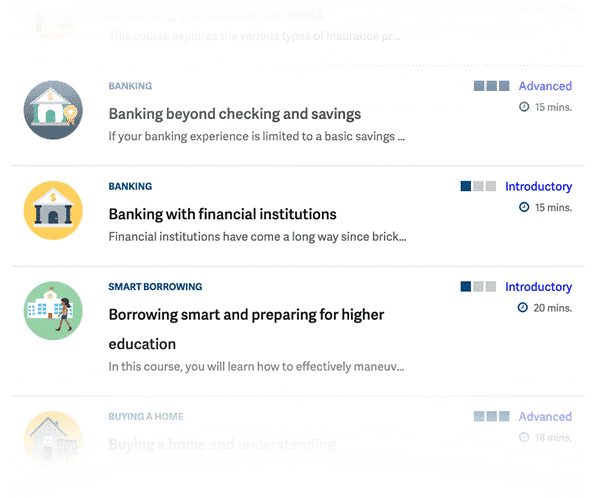

Step up your money skills with FinPath University

Courses are for everyone, no matter what sort of prior finance knowledge you have. Start with beginner 101 courses and move your way up the ladder with more complex topics. We break down complex financial topics using everyday situations.

Popular courses this year:

- 5 Tips to Maximize Your Paycheck

- Credit is a Powerful Financial Tool – Use it to Your Advantage

- Manage Your Debt or Your Debt Will Manage You

- Student Loan Forgiveness

Financial Health Tools

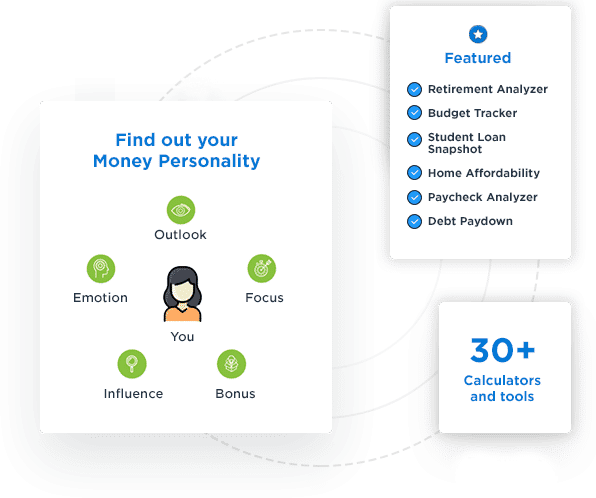

Take action and track your progress with powerful financial wellness tools

With Foundation 99, you have a complete suite of online tools to help you take control of your finances. Foundation 99 encourages you to perform a series of goals to improve your financial wellbeing—like establishing emergency savings funds, improving credit score, lowering their debt, and more

From retirement, to vacations, to buying a home, we can help you project how much you need to save to accomplish every goal.

Program Perks

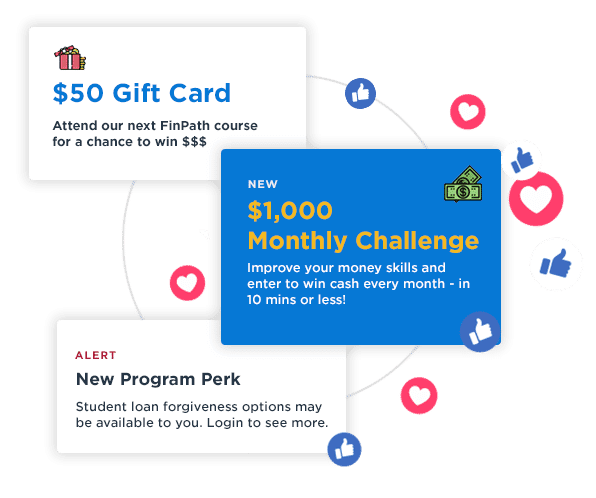

Get rewarded for improving your financial wellbeing

Foundation 99 partners with a list of preferred providers to bring you even more resources and rewards.

Current perks include:

- $1,000 monthly content

- Student loan forgiveness evaluations

- Identity protection and credit monitoring discounts

- Debt consolidation & emergency loans

- Nonprofit referral services

More coming soon!

DISCLOSURES

TCG Advisory Services, LLC (“TCG Advisors”) is a registered investment advisor regulated by the U.S. Securities and Exchange Commission (SEC) subject to the Rules and Regulations of the Investment Advisor Act of 1940, and is a part of TCG Group Holdings, LLP. Registration with the U.S. Securities and Exchange Commission does not imply a certain level of skill or training. We are located in Austin, Texas. A copy of our Form ADV Part 2 is available upon request.

This website is not authorized for use as an offer of sale or a solicitation of an offer to purchase investments. This website is for informational purposes only and does not constitute an offer to sell, a solicitation to buy, or a recommendation for any security, or as an offer to provide advisory or other services in any jurisdiction in which such offer, solicitation, purchase or sale would be unlawful under the securities laws of such jurisdiction.

Past performance may not be indicative of any future results. No current or prospective client should assume that the future performance of any investment or investment strategy referenced directly or indirectly in this brochure will perform in the same manner in the future. Different types of investments and investment strategies involve varying degrees of risk—all investing involves risk—and may experience positive or negative growth. Nothing in this brochure should be construed as guaranteeing any investment performance.

This website may contain forward-looking statements and projections that are based on our current beliefs and assumptions on information currently available that we believe to be reasonable; however, such statements necessarily involve risks, uncertainties, and assumptions, and prospective investors may not put undue reliance on any of these statements.

Salary Finance branded loans are offered by Axos Bank® Member FDIC, and are subject to eligibility, underwriting, terms and conditions, and approval. Employees who primarily work in DC, IL, IN, NH, NJ, NY and WV are not able to make repayments via salary deduction due to state legislation, and instead will be asked to choose an alternative repayment method.